- Alpha 36Ø

- Posts

- Big News for Bitcoin 📈

Big News for Bitcoin 📈

While not the BIG NEWS that everyone is awaiting (the spot ETF approval that is anticipated in the January 5-10th time frame), the recent FASB accounting rule change is also a very big deal that should significantly expand and hasten the willingness of big corporate firms to hold bitcoin as an asset in their Treasury.

I see the recent developments in the accounting of crypto assets as a significant shift in the financial world, one that could potentially bolster the adoption of Bitcoin and other cryptocurrencies as legitimate and stable financial assets.

The Financial Accounting Standards Board's (FASB) decision to adopt a Fair Value Accounting approach for crypto holdings for fiscal years beginning after December 15, 2024, is a game-changer (it’s mandatory after this date, but companies can opt-in now).

This new ruling, as reported by CoinDesk and Thomson Reuters, means that companies holding crypto assets will now report their value based on current market prices, not just the purchase price. This approach recognizes the dynamic nature of cryptocurrency values and allows for a more accurate representation of a company's financial health.

Previously, under the existing accounting standards, companies had to report a loss if the crypto they held was worth less than the purchase price, even if they hadn't sold the assets. This was a major issue for many companies, potentially impacting their financial statements negatively, despite unrealized losses. Fortunately or unfortunately, Wall Street is a very short term game with companies incentivized to game quarterly earnings to keep Wall Street analysts and investors happy.

This asymmetrical approach, accounting only for the decreases but not the increases in value, was not only inconsistent but also a deterrent to corporate adoption of cryptocurrencies as a treasury reserve asset.

The case of Tesla, which sold a portion of its Bitcoin holdings, is a notable example. The decision was, in part, influenced by the need to manage the impact of Bitcoin's fluctuating value on their balance sheet. With the FASB’s new ruling, such drastic measures might not be necessary in the future.

Michael Saylor, a well-known Bitcoin advocate, rightly points out that this upgrade to accounting standards will facilitate the broader adoption of Bitcoin as a treasury reserve asset. Corporations can now more confidently include Bitcoin in their asset portfolios, knowing that its value will be reported in a way that reflects actual market conditions.

James Lavish's Twitter thread further elucidates this point:

“FASB initially decided that Bitcoin should be considered a long-lived intangible asset.

What this means is that if a company buys Bitcoin, it must list it on its balance sheet at the lower amount of cost or market value.

For example:

A public company uses some extra cash to buy $1M of Bitcoin, and lists the holding as a Digital Asset on its balance sheet, worth $1M

Then the Bitcoin price rises 20%

In its financials, the company cannot recognize this increase and must maintain Bitcoin at $1M.

Then, let’s say that Bitcoin falls 50%, and is now worth 60% of where the company bought it

In its financials, the company must recognize this decrease as an impairment in value and list its Bitcoin holdings at $600K, with a $400K loss.

Even if Bitcoin then trades back up, $600K would remain the carrying value for the company’s balance sheet going forward

The only way to recognize price recovery is to sell the Bitcoin and trigger a *capital gain*

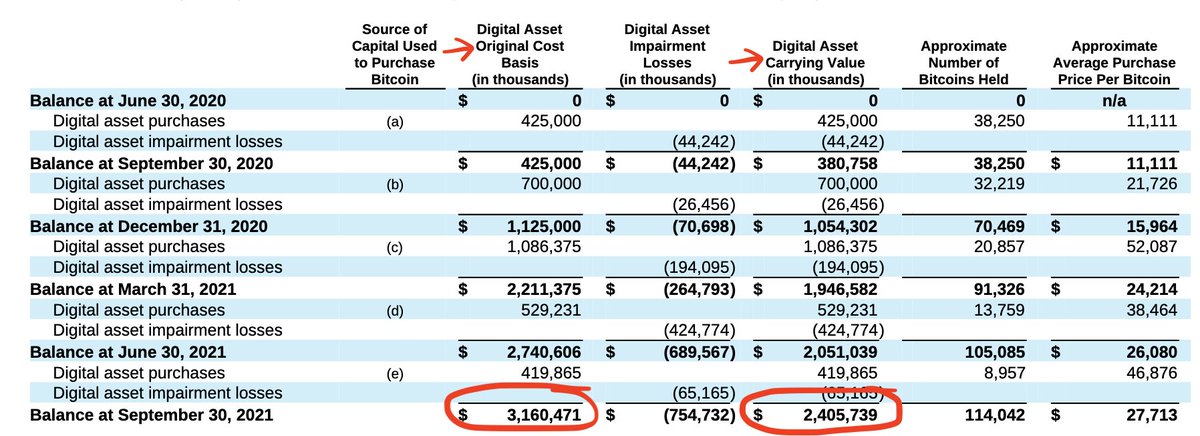

This is exactly what happened to MicroStrategy.

Michael Saylor bought billions of dollars of Bitcoin, the price increased, and he had to hold the Bitcoin on MicroStrategy’s Balance Sheet at the purchase price

Then, when Bitcoin fell in value, MicroStrategy had to recognize the impairment, and list it as a loss.

Furthermore, when Bitcoin recovered in price, MicroStrategy could not recognize this recovery, and they had to keep the value on its books at that 'impaired' level

Even though Bitcoin had since recovered much of the value.

MSTR 10-Q 09/30/2021:

And so instead of listing the value where it was now trading in the markets, MicroStrategy had to just include a footnote to show what the actual trading value was at the time of the financial statement, instead.”

This shift in accounting standards is not just a technical adjustment; it is a significant change in the corporate world and represents a broader acceptance of cryptocurrencies within mainstream financial practices.

CONCLUSION: the FASB’s move to adopt Fair Value Accounting for crypto assets is a substantial step forward for the cryptocurrency market. It not only legitimizes the use of crypto assets in corporate finance but also aligns their accounting treatment with that of other assets. This could be the push needed for more corporations to consider Bitcoin and other cryptocurrencies as viable components of their financial strategies.

For more insights, I recommend checking out James Lavish’s Twitter thread.

I’ll have a note this weekend for paid subscribers how to position yourselves for the upcoming Jan 5th-10th ETF approval window if you’re tracking my portfolio.

Reply